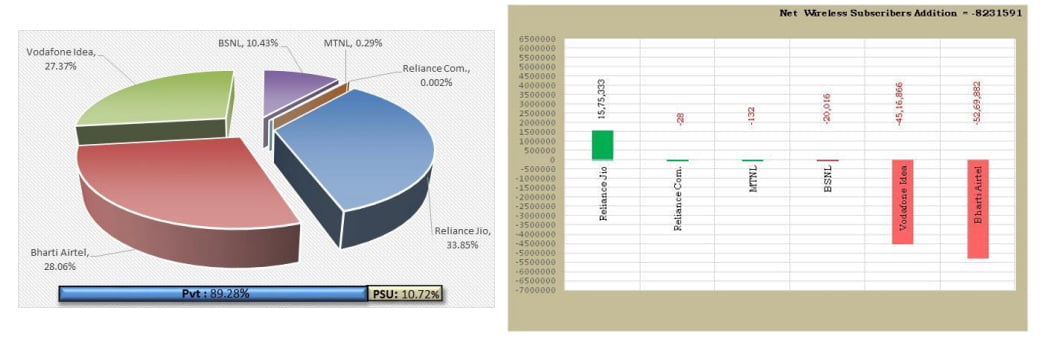

During April this year, the first full month of lockdown in India due to coronavirus, Indian telecom operators saw massive erosion of their mobile subscribers. Telcos lost more than 8.2 million or 82 lakh subscribers in the month of April 2020 alone, says TRAI. The worst part, subscriber loose is majorly in the urban sector.

According to the latest Telecom Subscription Data for April 2020 by TRAI, Vodafone Idea continues bleeding. The telco alone lost around 4.5 million wireless subscribers (2G, 3G and 4G). While Airtel lost more than 5.2 million subscribers and BSNL lost around 20K subscribers.

However, during this turmoil in the market, Reliance Jio continue its spree and kept its trend of adding more subscribers to its network. The telco added 15.75 lakh, new subscribers, to its 4G-only network in the month of April alone.

Another trend marked by the large-scale migration of people from cities to villages, saw urban wireless subscribers decreased to 629.44 million at the end of April 2020. At the same time, there has been an increase in subscribers in the rural area. Urban teledensity decreased from 138.41 per cent to 136.22 per cent, whereas dual teledensity saw a marginal increase from 58.54 per cent to 58.61 per cent.

Stats on Indian Telecom (April 2020)

- The number of telephone subscribers in India decreased to 1,169.44 million.

- The total wireless subscribers, which also includes 2G, 3G and 4G LTE subscribers in the country also decreased to 1,149.52 million. That’s a monthly decline rate of 0.71 per cent.

- Private telecom operators hold 89.28 per cent market share in the Indian telecom sector. Whereas both PSU telecom operators BSNL and MTNL together hold 10.72 per cent of the pie.

- Reliance Jio was the only telco who added a sizeable number of subscribers to its network – 15.7 lakh.

- On the losing side, we have Vodafone Idea, Airtel and BSNL.

- Reliance Jio retains the top position in India telecom sector with 33.85 per cent market share. Followed by Airtel with 28.06 per cent market share and Vodafone Idea with 27.37 per cent market share.

- Wireline subscriber base decreased to 19.92 million in April 2020. BSNL along with MTNL topped the wireline segment with 58.14 per cent market share.

- Reliance Jio with its Jio Fiber is slowly expanding its reach and now commands 5.73 per cent of the wireline segment.

- There was 0.90 million Mobile number portability (MNP) requests in April 2020.

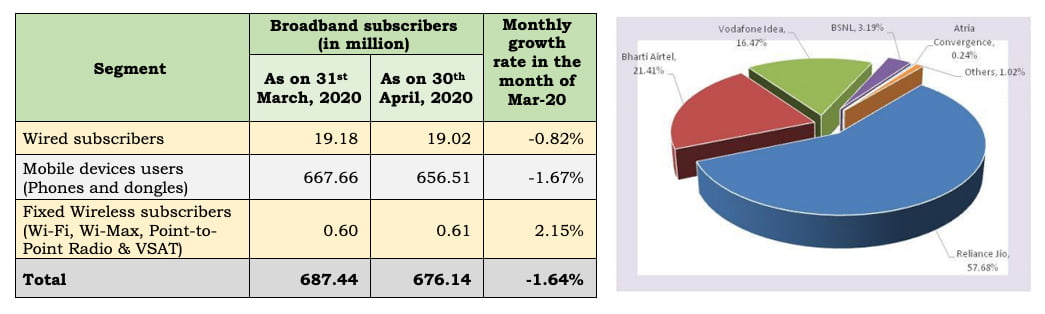

Stats on Indian Broadband (April 2020)

- The number of broadband subscribers, which include both mobile and wired subscribers decreased to 676.14 million.

- Reliance Jio tops the chart in the data market in the country with 389.99 million subscribers. Airtel takes the second spot with 144.76 million data subscribers.

- In wired broadband connections, BSNL continues to hold the top spot with 7.97 million subscribers. On the second spot, we have Airtel Broadband with 2.44 million subscribers.

- Reliance Jio is slowly showing up in the charts with its 0.90 million wired broadband subscribers through Jio Fiber.

- In the Wireless broadband service (3G, 4G) providers ranking list (based on the number of subscribers) Reliance Jio tops the chart, followed by Airtel and Vodafone India.