Finally, after years of regulatory followups, Facebook-owned chat service WhatsApp gets official nod to start UPI payment service in India from National Payments Corporation of India (NPCI), the umbrella organisation behind Unified Payment Interface (UPI) and Rupay card.

Those who want a recap, WhatsApp began testing of UPI payment service back in 2018 with a limited set of users onboard. But, the company failed to fully roll out the service back then due to regulatory hurdles. Now, the company has finally completed the regulatory requirements and can expand its UPI user base in a graded manner. Thus the rollout would be in a phased manner with a maximum registered user base of up to 20 million users.

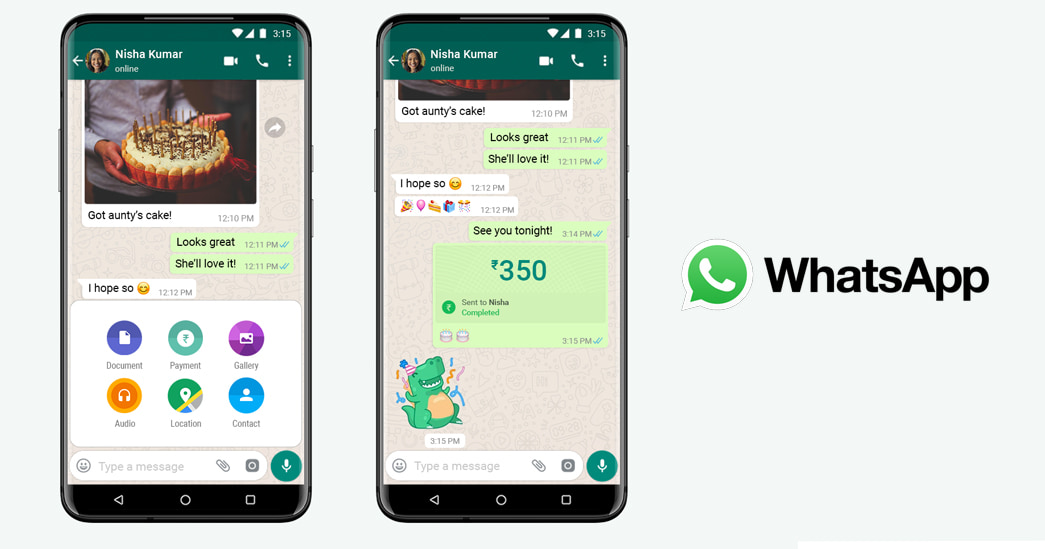

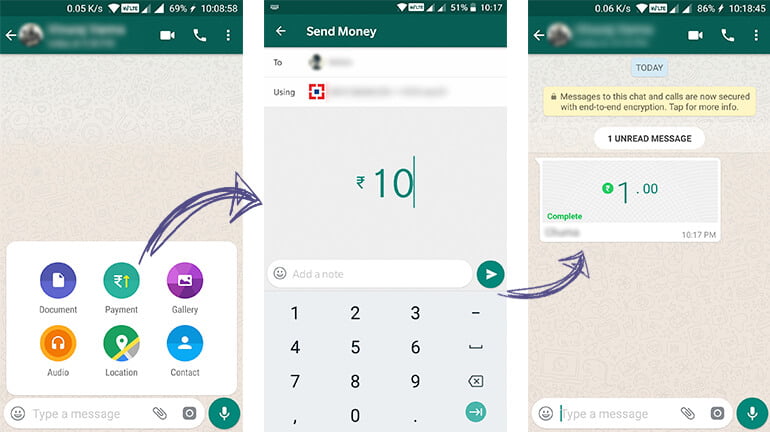

WhatsApp Payments, just like any other UPI-based apps BHIM, Google Tez, PhonePe or Amazon Pay UPI allows you to send or receive money instantly via UPI. You need to select a contact or business, tap on the attach button to select “payment option” (Rupee symbol), type in the amount you want to send and enter your UPI pin to proceed.

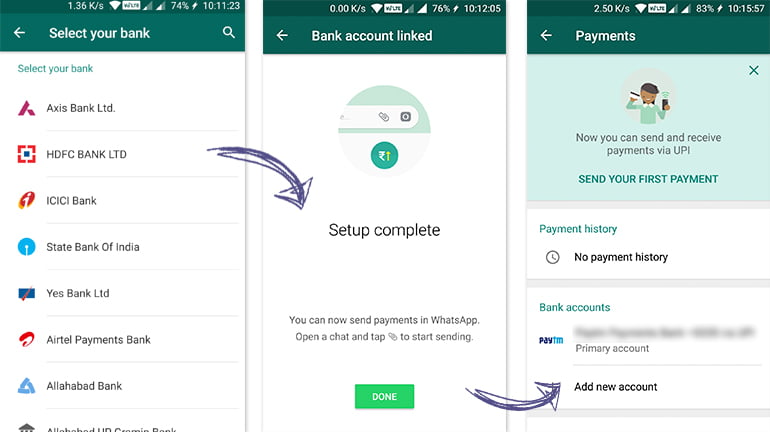

On the receiving end, the money will be instantly credited directly to the WhatsApp user or business bank account, thanks to UPI. This time around, the Facebook-owned service has partnered with five leading banks in India for UPI in the multi-bank model. These banks include ICICI Bank, HDFC Bank, Axis Bank, the State Bank of India, and Jio Payments Bank. Thus you could create a UPI ID or handle with any of these banks. You could also share the UPI ID to anyone, and they can send money on WhatsApp to anyone using any UPI supported app.

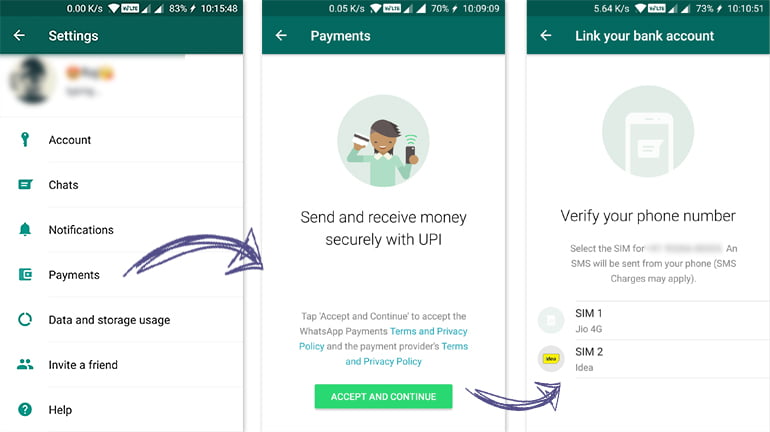

How to setup WhatsApp Payments UPI

- First, head over to the “Payments” option under your WhatsApp setting.

- WhatsApp will verify your phone number (SMS charges will apply). If you got dual SIMs, make sure you verify that phone number which is linked to your bank account.

- Once verified, you will be shown the option to select your preferred bank.

- As with every other UPI-based app, you need to create a new VPA (Virtual Payment Address). However, in WhatsApp Payments, it auto-creates a unique VPA with your mobile number as the base. For example, your WhatsApp Payments VPA will be something like phonenumber.wa.rvh@icici. (Currently, there is no option to edit this VPA).

- Once you select your preferred bank, it will be linked to your WhatsApp. You can add any number of banks (linked to your mobile number) and then choose the default bank account to send and receive UPI payments.

- You also need to set up a security pin for the UPI, if it’s not already set up.

- That’s it! You have fully configured WhatsApp Payments and now can start sending money.

One of the unique advantages of using WhatsApp Payments is that you won’t need to remember your UPI VPA. WhatsApp cleverly hides your VPA deep under its settings. For sending money you just need to select a contact or business account, start a new conversation or choose an existing conversation, tap on the attach button, choose the Payment icon and enter an amount with an optional message and send it through.

WhatsApp with UPI integration place it in a unique advantage over its peers, because it hosts one of the largest personal messaging services. Essentially, all your friends or family are already using WhatsApp, and with a few click of a button, anyone can activate WhatsApp Payments. Another big advantage would be for WhatsApp Business users as they can now instantly collect payments from its users.