India’s major telecom operator Vodafone India has joined hands with ICICI Bank to launch ‘M-Pesa’, a unique mobile money transfer and payment service for Vodafone subscribers. Currently the service is being offered in the eastern parts of the country which include Kolkata, West Bengal, Bihar and Jharkhand through over 8300 specially trained authorized agents.

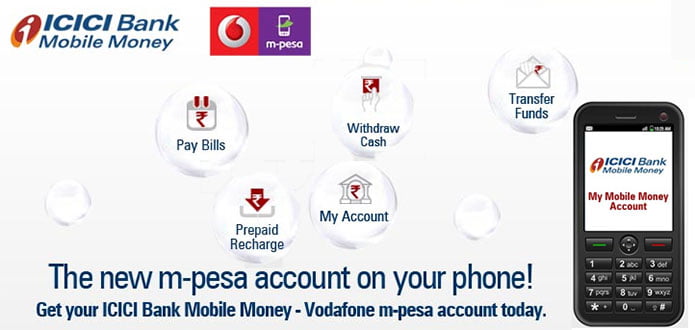

M-PAiSA provides an instant, secure, affordable and convenient means to sending and receiving money anywhere in India and is available to every registered subscriber on the Vodafone network, whether on Prepay or Postpay. Registration to access the M-PAiSA service is absolutely free. Using M-Pesa account, customers can –

- Deposit and withdraw cash from designated outlets

- Transfer money to any mobile phone in India

- Remit money to any bank account in India

- Make payments to recharge mobile, clear utility bills and for DTH service subscription

- Shop at select shops

- Participate in e-commerce/m-commerce

“Vodafone is the world’s ndia said largest and leading provider of mobile payment services using ‘‘‘M-Pesa, which offers millions of people basic financial services, beyond the reach of traditional banking. Mobile technology has a critical role to play in servicing the unbanked and underserviced sections of the society and we are delighted to introduce this world class offering in India in partnership with ICICI Bank. Using M-Pesa, we will provide people in remote areas a convenient way to bank, transfer money and make payments in a safe and secure manner. We have customized our offering to serve the needs of Indian customers while ensuring its compliance with all applicable regulations. Financial inclusion is a national priority and we believe that with ‘‘‘M-Pesa, we now have the ideal offering to enable the same.”said Marten Pieters, Managing Director & CEO, Vodafone India.

How does it work?

Registering for M-Pesa is easy and simple, Vodafone customers need to visit an M-Pesa agent outlet, fill up a form, submit identity, address proofs and deposit a minimum amount along with it, to open their M-Pesa account. The MCSL Mobile Wallet get activated immediately and the customer can do a variety of transactions like cash deposit, transfer money to any bank account, money transfer to any other M-Pesa customer, recharge mobiles & DTH, pay mobile and utility bills. Once the documents are verified and approved by MCSL and ICICI Bank the customer can do other transactions viz. cash withdrawal and sending money to any mobile number. Here’s a video explaining the above (it’s a Vodafone South Africa based Ads video, but it explains how ‘M-Pesa’ work) –

Vodafone and HDFC Bank has already partnered to offer m-paisa mobile money transfer service nationally. They have partnered with over 2,200 retailers across 320 villages and 54 towns operating across the country for the M-Paisa mobile money transfer service.

Source – ICICI Bank M-pesa