Are you a shop owner or merchant who want to go cashless and adopt digital payments? Bringing the convenience of Unified Payment Interface (UPI) payment to the existing point of sale (POS) terminals, National Payments Corporation of India (NPCI) has introduced UPI@POS. An in-store UPI solution which enables POS terminals to accept UPI-app based customer payments.

UPI@POS is a product developed by innoviti in partnership with NPCI and Axis Bank. In a nutshell, the product enables existing credit/debit card POS terminals you find at stores to accept UPI-based payments. For this, the POS terminal will generate a dynamic QR-code as per the transaction, which you can scan with your UPI-based apps and instantly make cashless payment.

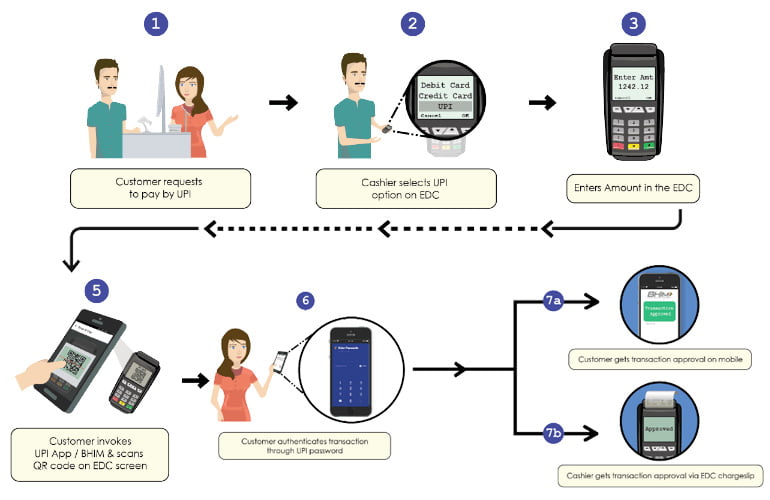

So how UPI@POS works? For this, Merchants need a compatible POS terminal that can accept UPI payments. When a customer request UPI payment, the merchant can select UPI option under POS machine. After the amount has been entered, the POS machine will generate a QR code that customer can scan using any UPI-based app like BHIM or PhonePe. Here the POS machine is actually sharing the merchants UPI VPA along with amount requested via the dynamic QR code.

Once customer authenticates the transaction, money will be transferred instantly from their UPI-linked bank account to merchants bank account. The POS machine will print out a confirmation slip and customer will also get a confirmation message as SMS or notification.

How UPI@POS Works?

- UPI@POS payment solution works with the existing credit/debit card POS terminal that’s enabled for UPI-based payments.

- When you requests UPI payment mode, the merchant needs to select ‘UPI Payment’ option under the POS terminal and enter the transaction amount.

- Once the amount is entered the POS machine will generate a dynamic QR-code on the POS terminal screen itself. You can then scan this QR code using any mobile-based UPI apps.

- When scanned, the QR code automatically transfers relevant transaction details to your UPI app and ask for authorising the money transfer.

- Once you authorise the transfer (using UPI PIN), money will be instantly transferred from your UPI-linked bank account to Merchants UPI-linked bank account.

- The POS machine will generate a transaction receipt and you will also get a confirmation message.

UPI@POS Advantages

For merchants, one of the main advantages of using UPI@POS is that they won’t need to spend extra money on a new hardware. It works on existing credit/debit card POS terminals. In addition unlike the card payments, UPI-based customer payments are immediately credited to the merchant’s bank account. There will be no delays or hefty transaction charges involved.

For customers, UPI@POS offers an extra convenience to go cashless. It’s 100 percent secure as you are not sharing any card details or personal details with the merchants. All transaction are authorised through a UPI PIN or using your mobiles biometric scan. As money is transferred directly from your UPI-linked bank account, you won’t need to carry around multiple cards. However, there is a certain limitation too, like the existing one lakh transaction limits for UPI.

The UPI@POS payment solution will initially roll at Reliance Retail outlets in Mumbai. This includes Reliance Fresh, Reliance Digital and Reliance Smart outlets which will start accepting UPI payments from customers. Reliance Retail plans to roll out the payment solution to all its store country-wide in the coming months. NPCI also hope to see more merchants and retail outlets choosing the new UPI@POS payment solution in the coming months.