There are times when we go out with friends for a dinner and need to split our food bills. It’s a pain to collect money from each of your friends, then start calculating and counting on it. Instead, it would have been way easy if there is a way everyone can instantly transfer the money to one person’s account and then he can pay the bill.

Well, the more advanced cashless payment solution is here. The National Payments Corporation of India (NPCI) the government organisation behind all retail payments system in India has developed and made live the Unified Payments Interface (UPI). A new payment system that allows users to easily send and receive money using a smartphone.

UPI has gone live for customers with 21 Indian banks. The UPI app of 19 banks will be available on the Google Play Store starting today and the iOS version within a few months.

What’s UPI app?

UPI is a unique payment solution which allows instant money transfer between any two users using a smartphone. It’s a more advanced version of IMPS, which lets you transfer money in real-time, 24×7 and without exposing your personal details.

You can instantly start using UPI, all you need is a bank account (from any supported bank), an android smartphone, and a working internet connection.

How UPI works?

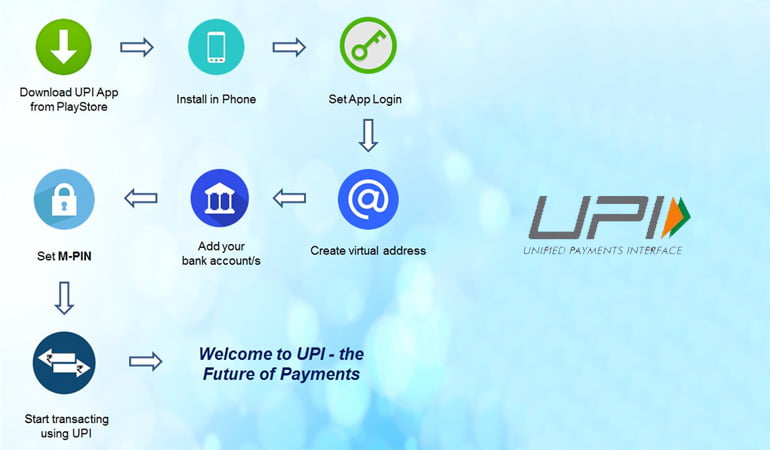

First, you need to download the UPI app for your bank from Google Play store. Then set an app login for securing the access to the app. As for the payment to happen, you need to create a virtual payment address or a unique ID. The unique ID can be your mobile number or a short name of your choice which will be linked to your bank account.

For instance, your unique ID can be like 1234567890@axis, where 1234567890 will be your mobile number and axis (shortcode to Axis bank) would be your banks. This safeguards users privacy, as no bank account number, name, and other details are exposed. For users having multiple bank account, they can have different virtual addresses for multiple accounts in various banks.

Once you are all set, sending money using UPI is way simple. Just open up your UPI app, head over to send money and enter the other person’s virtual payment address or a unique ID. All transaction are secured with two-factor authentication. Once verified the money will be instantly transferred to the recipient.

The transaction limit is set to as low as Rs 50 and goes all the way up to Rs 1 lakh. Which seems to be fair enough for a day-to-day transaction like online shopping, recharging, splitting bills and more.

So where can use UPI? Instead of paying hard cash during the COD orders for online shopping, you can use UPI to instantly transfer the money. UPI also works in paying utility bills, doing recharges, barcode (scan and pay) based payments, donations, school fees, fund transfer your friends or family and more.

Now on you just don’t need to carry around cash or Credit/Debit cards. Just with your smartphone and UPI supported bank app go cashless and pay or receive money instantly.

UPI benefits

- Send and receive money instantly using your smartphone.

- Virtual Payment Address (VPA) or unique ID for sending and collecting money.

- 24X7 and real-time funds transfer service.

- Secure with single click two-factor authentication.

- Transaction limit – minimum Rs 50 and maximum Rs 1 lakh per transaction.

- Safeguard privacy of customer’s data.

- Currently supported by 21 banks

Bank supporting UPI payment

Back in April 2016 RBI Governor Raghuram Rajan soft-launched the new payments architecture UPI which allow instant online money transfer. After the pilot run, NPCI decided that only the banks with 1000 pilot customers, 5000 transactions and success rate of around 80 percent would be permitted to go live.

This criterion helped banks to refine their systems of any technical glitches and gives a smooth experience to customers. Out of the 29 participating banks, 21 banks have got the final approval to release their UPI app on mobile stores.

So which banks support UPI? Customers of following banks can start utilizing the UPI service – Andhra Bank, Axis Bank, Bank of Maharashtra, Bhartiya Mahila Bank, Canara Bank,Catholic Syrian Bank, DCB Bank, Federal Bank, ICICI Bank, TJSB Sahakari Bank, Oriental Bank of Commerce, Karnataka Bank, UCO Bank, Union Bank of India, United Bank of India, Punjab National Bank, South Indian Bank, Vijaya Bank and YES Bank.

In addition IDBI Bank and RBL Bank are on-boarded as issuers, which enabled its customers to download any UPI enabled Apps mentioned above and link their account.

You guessed right, India’s largest bank State Bank of India (SBI and other subsidiary banks), HDFC bank and CitiBank are not on the list. Maybe they have not yet passed the threshold criteria set by NPCI or may be some other reason. We hope this banks also come up with the UPI app so that service would get mass adoption.