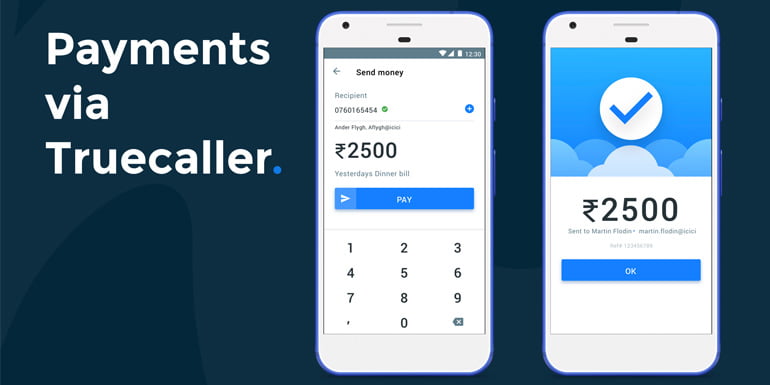

Going digital, and going cashless is the way forward to the future. We have banks introducing their individual UPI apps and also government’s own BHIM app, but there is a big learning curve with each new app. Simplifying peer-to-peer payments, Truecaller has launched UPI-based mobile payment service ‘Truecaller Pay‘ in partnership with ICICI Bank.

The payment service utilises Truecaller mobile identity platform and banking expertise from one of India’s leading private sector bank, ICICI bank. Simply, you can now use Truecaller app to send and receive money. So, you won’t need to install multiple apps or remember multiple logins.

Coming to the details, Truecaller Pay UPI mobile payment service is part of the Truecaller app. It allows you to create a UPI Virtual Payment address (VPA) ID, send money to any UPI account and receive UPI payment from anyone. It allows you to recharge your mobile number from within the Truecaller app. The app also aggregates the UPI ID’s of users and links them to the contact details in your address book.

Get started with Truecaller Pay

- First, you need to install or update to the latest version of Truecaller app (version 8) [link].

- Choose ‘Send money through UPI‘ from Truecaller app’s profile page.

- You can now create a new UPI VPA or you can add your existing ICICI Bank VPA.

- For ICICI Bank users with existing UPI ID, the bank will automatically show the UPI ID. You can also create a new UPI ID by entering the grid value on your debit card.

- For Non-ICICI Bank customers, users need to select their bank. Then they need to enter the last six digits of their debit card number along with expiry details to create UPI VPA.

- Once you have the UPI VPA, you can start sending and receiving money via Truecaller Pay.

- To send money, under Truecaller Pay enter the recipient UPI VPA or mobile number (registered with BHIM app), the amount and click on ‘Pay’.

- You also need to authenticate the transaction via UPI PIN.

Truecaller Pay utilises bank grade security features from ICICI bank. Every transaction through Truecaller Pay follows the mandatory two-factor authentication as per RBI guidelines for secure money transfer. To further protect your privacy, all sensitive data like account details, credit card or debit card details etc are securely handled and stored by ICICI Bank as per NPCI and RBI guidelines.