Updated at March 22, 2017:

Samsung Pay has officially opened up for all users in India having a compatible Samsung device

https://www.datareign.com/samsung-pay-india-open-everyone-upi-payment.html

Our original story from Tuesday, February 6, 2018, follows:

Now pay securely without sharing your card details or even swiping the card on the PoS (point of sale) machines. Samsung has launched its mobile payment service ‘Samsung Pay’ in India. Exclusively available for Samsung devices, the payment service supports credit card, debit card and Paytm digital wallet.

You can now signup for the Samsung Pay early access program [link], where you can setup your account and start using the payment service. Currently, a limited number of banks support Samsung Pay. This includes HDFC Bank, Axis Bank, ICICI Bank, SBI and Standard Chartered bank. You can also link your Paytm wallet account with the service. Samsung will soon start supporting American Express cards and cards from Citi bank.

As we said earlier, Samsung Pay is currently exclusive for Samsung devices. The payment service works with Galaxy Note5, Galaxy S7, Galaxy S7 edge, Galaxy S6 edge+, Galaxy A7 (2016), and Galaxy A5 (2016). The recently launched 2017 edition Galaxy A5 and A7 devices will also be compatible with Samsung Pay.

How to register for Samsung Pay?

- First, you need to have a compatible Samsung device and if you got one, then download the Samsung Pay app from Google Play store.

- Launch Samsung pay app and sign in/sign up with your Samsung account.

- On Samsung Pay tap ‘Use Fingerprint’ to register your Fingerprint or you can set up a four-digit Samsung Pay Pin which will be used for all payment authentication.

- Choose ‘Add’ to add your Credit card or Debit card. Here the camera opens and it auto-reads your card details or you can enter the card details manually.

- There will be a one-time authentication using OTP from your bank.

- You can also select ‘Wallet’ and add Paytm Wallet to Samsung Pay.

- Once cards/wallet are added you can start using Samsung Pay at any shops.

How does Samsung Pay work? Those who are hearing about Samsung Pay for the first time, the mobile payment service uses Near Field Communication (NFC) and Magnetic Secure Transmission (MST) on your mobile devices to make payments. Once you have added your credit card or debit card to Samsung Pay, you can pay at a store or retail outlet where you usually swipe or tap your card.

For NFC payments to work, the merchant or shop owner need to upgrade their PoS terminal to accept contactless payments. But Samsung Pay also comes with MST support which works with already existing or any PoS terminal which uses swiping your card through the reader. The MST replicates a card swipe by wirelessly transmitting magnetic waves from the supported device to a PoS card reader.

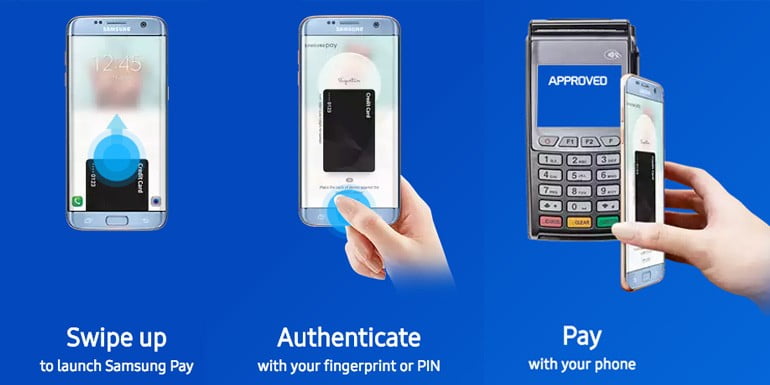

How to make payments with Samsung Pay

- For initiating a payment open Samsung Pay app or swiping up from any screen on your Samsung device.

- Choose the credit card or debit card or Paytm Wallet to pay with by swiping left or right.

- Verify your fingerprint or enter your four-digit Samsung Pay pin and place your phone near to the card reader or NFC reader to complete the payment.

- In case prompted for a PIN, you may be required to input four-digit Card PIN (ATM pin of the card).

To register and activate your cards on Samsung Pay you need an active internet connection. However, an active internet connection is not required to make in-store card payment using Samsung Pay. Also, you can add up to 10 payment cards (Credit cards and Debit cards) in Samsung Pay.

If you are worried about security, then Samsung Pay uses tokenization and authentication methods to secure your information. Every transaction using Samsung Pay is authenticated via either fingerprint or secured PIN. In addition, Samsung’s KNOX service constantly monitors suspicious activity within the device to protect from any malicious attacks.

Please note that currently, Samsung Pay won’t allow you to withdraw cash from ATMs. It also won’t work while making payments on online e-commerce stores.