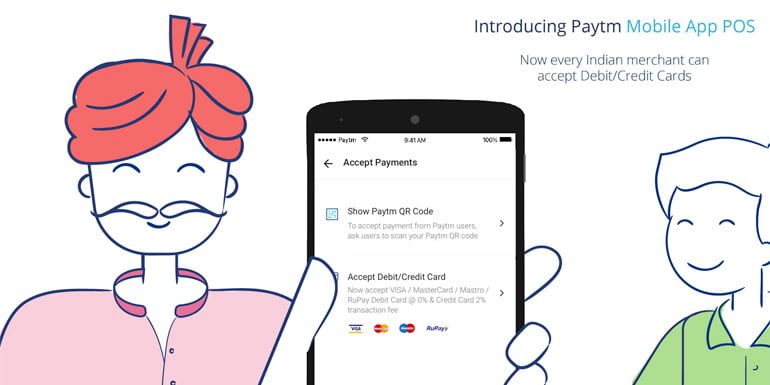

Within a day of launching ‘Paytm Mobile App PoS’ (Point of sale) service that allowed merchants to accept debit card and credit card payments from customers without actually owning a physical PoS machine, has been withdrawn citing security concerns. Under the service customers needed to enter his/her card details on the merchant’s phone, which raised security concerns.

The idea for Paytm Mobile App PoS was great, as it eliminated the need for a costly physical card swipe machine. Which was also perfect for small shop owners and merchants who can easily accept card payments directly from customers in the wake of currency demonetization.

The Paytm Mobile App PoS facility drawn criticism from day one from the likes of MasterCard and Visa along with government bodies. The process involved the customer in entering their card details on a third party device. Although Paytm claimed during the payment flow, the company does not store any card details in its App or servers. The transaction is completed on the bank’s page and follows the two-factor authentication guidelines mandated in India.

“Post our launch, we have had several discussions with stakeholders on how we can make this process even more secure. Based on some suggestions from the industry, we have decided to add additional certifications and features before making it available to merchants. We will re-launch this product as soon as we have updated the product.” said Paytm in its official blog.

Paytm is a PCI DSS (Payment Cards industry Data Security Standard) certified company. It’s IT systems audited periodically by certified independent auditors.