Finally, you can now experience what’s touted to be one of the finest Payments Bank service. India’s leading digital mobile wallet provider Paytm’s Payments Bank is live on its mobile app. If you are on the beta channel of Paytm’s Android mobile app then a new update which takes the app version to 6.0.0 bringing the Paytm Payments Bank service.

Prerequisite to open a savings account at Paytm Payments Bank, you need to be KYC verified. At anytime you can upgrade your existing Paytm Wallet account by doing an e-KYC verification. For that, you need to provide your Aadhaar and PAN card details with Paytm. Once validated, you can visit the nearest KYC center or a Paytm agent will visit your home/office and uses biometric details from Aadhaar to verify your account. Once verified you can visit Paytm Payments bank and request an invite to open a saving account.

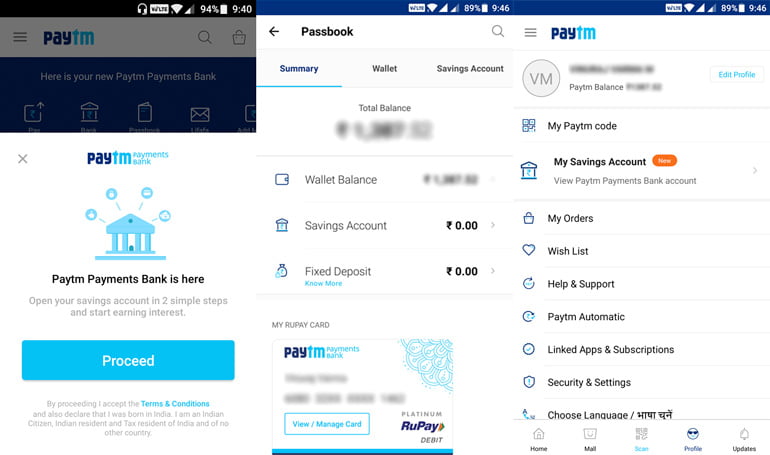

Back to the Paytm beta app, where you can now open your saving account with Paytm Payments Bank. Once you have updated the app, on your first opening of the app you will be greeted with a small slide pop up prompting you to open the savings account. You can also visit your Paytm profile page where you will find a new menu item “My Savings Account”. You can then setup your Paytm Payments Bank savings account in 2 simple steps. First, setup a secure four-digit passcode. Second, adding a nominee to your account (nominee can be added later from your account). That’s it, you have successfully opened your saving account with Paytm Payments Bank. The best part your mobile number will be your savings account number.

The Paytm Payments Bank savings account passbook will show a summary of your account. This includes the total balance available in your account as Paytm Wallet balance, Saving Account balance and Fixed Deposit balance. It seems Paytm has yet to merge its digital Wallet with the Savings account. Currently, you can only add money to your Paytm savings account via IMPS or NEFT from any other bank’s app or website. Maybe in future Paytm will add UPI payment method to the list.

With the Paytm Payments Bank savings account you will also get a RUPAY Platinum virtual debit card. Basically, this allows you to use the money in your Paytm savings account anywhere online to do a digital transaction. You also have the option to block the card in case of misuse.

Another interesting thing we found is the ‘Fixed Deposit’ option. Payments Bank, in general has an upper account limit of one lakh. So, if your total Paytm balance exceeds this INR 1 lakh (may be through money deposit or cash backs etc) then a fixed deposit of exceeded amount will be automatically created for you by Paytm. Well, for the fixed deposit you will get a good interest rate of around 6.85 percent on a maturity period of 13 months. On maturity, you can instantly redeem the amount and there are zero charges for that (TDS will be applicable on the interest amount). For the Fixed Deposit service, Paytm has partnered with IndusInd Bank Ltd.

Paytm Payments Bank Live on Beta App

- Paytm Payments Bank is currently live on Paytm Beta mobile app for Android (v 6.0.0).

- You can open a savings account on Paytm Payments Bank only if KYC verified (Aadhaar and PAN verified).

- Your mobile number will be your Paytm Payments Bank savings account.

- You can add money to Paytm Savings account via IMPS or NEFT.

- Paytm IFSC code will be PYTM0123456 or PYTM0000001.

- You will get a RUPAY Platinum virtual debit card that can be used for online transactions.

- Paytm Payments Bank has a maximum limit of Rs 1 lakh.

- A fixed deposit will be created automatically with the amount exceeding the above account limit.

- You will get a Fixed Deposit interest rate of around 6.85 percent on a maturity period of 13 months.

Paytm Payments Bank started its operation on 23rd May 2017, on an invite-only basis. For those new to Payments Bank, the Reserve Bank of India (RBI) back in 2015 granted Payments Bank license to eleven entities including Paytm. Payments Bank operate as a differentiated bank and can accept demand deposits, remittance services, internet banking and other specified services. But it can’t provide money lending services like loans. The main purpose of this type banks is to serve certain niche interests, remittance needs of small businesses, unorganised sector, low-income households, farmers etc.

You can deposit a maximum of Rs 1 lakh to Paytm Payments Bank. For the deposited money, you will get an interest of 4 percent per annum, paid monthly. Further, safeguarding your money Paytm will use the deposited money from its account holders to invest only in government bonds that are used for the development of our nation. You can also access a range of financial services such as Insurance, Loans and Mutual Funds offered by partner banks.