Here comes a new entrant to the emerging Indian digital mobile wallet services. Reliance Industries Limited’s telecom arm Reliance Jio Infocomm Ltd (RJIL) has soft launched the semi-closed digital wallet service – JioMoney.

Currently, under beta version, the JioMoney service seems to be open to public with support for android and iOS devices.

JioMoney is a digital mobile wallet service just like Paytm, FreeCharge, and MobiKwik Wallet. One can load money to the wallet and use that money across physical stores and online channels for recharging, shopping, transferring money etc.

One can freely register with JioMoney using his/her mobile number, which also act as the unique ID of the person. Once verified using the SMS OTP, they can add cards, load funds and start using JioMoney.

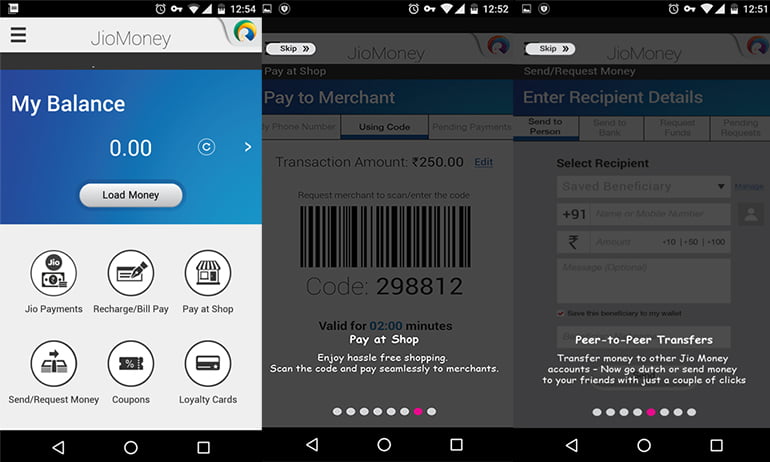

JioMoney features

- Recharge mobile, DTH, Data cards or make Postpaid, Electricity, Landline, Insurance and Gas bill payments.

- Pay online at any e-commerce website that accepts JioMoney wallet or using the JioMoney card.

- Pay at offline stores using the ‘Pay at Shop‘ feature.

- Send and request money between friends and family.

- Send money to any mobile number (currently users cannot send money to a non-JioMoney recipient) or bank accounts in India.

- Use Reliance loyalty cards like Reliance One and Reliance One -family cards.

JioMoney ‘Pay at Shop’

Customers can use JioMoney at any offline stores who are already registered as Merchants. Pay at the store by sending the amount directly to the merchant’s mobile number or by generating a QR/Barcode (on clicking the ‘Pay at Shop’), which will be then scanned by the merchant m-POS device.

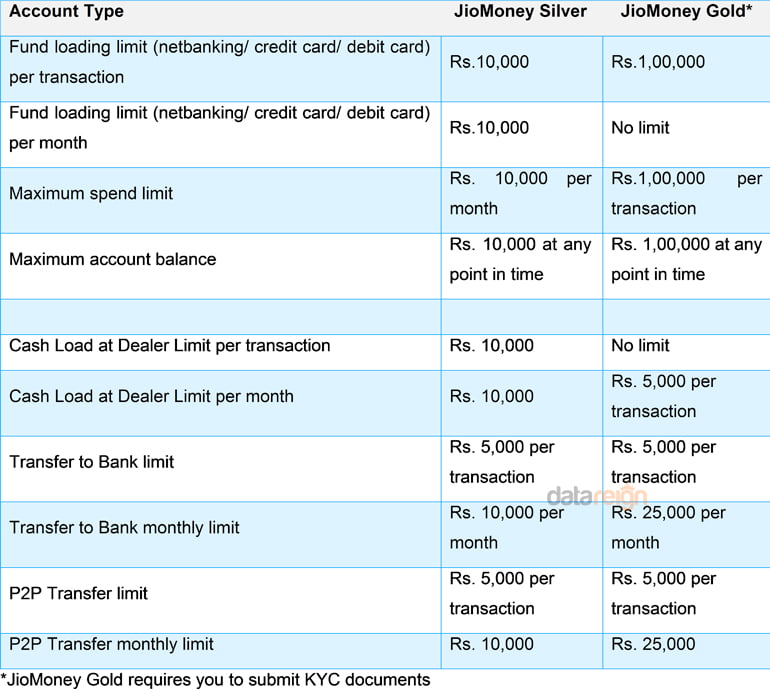

JioMoney Silver & Gold accounts

There are two types of JioMoney accounts – JioMoney Silver and JioMoney Gold. JioMoney Silver is the basic/default account which doesn’t need any sort of documentation but got a maximum spent/load limit of INR 10,000 per month.

Whereas for the JioMoney Gold account one need to submit their KYC documents (Proof of Identity and Proof of Address) after which the maximum spent limit is increased by INR one lakh per month and there is no limit on adding funds.

The easy part here is that user can upload the KYC document directly from the app (‘Upgrade Wallet account’ under ‘Account settings’ of the app) and get verified.

JioMoney Card

JioMoney also offers a virtual credit card that can be used as a debit card or credit card for online or offline purchases (currently there is a limit of Rs 250 per day or maximum 5 transactions below Rs 250 per day).

As a security measure, all card transactions on JioMoney got a pre-set limit and requires a PIN authentication. According to the company, customers details, credit, and debit cards information are stored in secure servers, using world class security process and technologies.