The new entrant in Indian telecom sector, Reliance Jio continue to get lots and lots attraction from the Indian masses. According to Telecom Regulatory Authority of India (TRAI) telecom subscription data for the month of December 2016, Jio added ten times more new subscriber to its networks when compared to incumbent telcos. Going through numbers, Jio added around 20.2 million new subscribers to its 4G only network. At the same time Idea Cellular taking the second spot with 2.8 million new subscribers, followed by Airtel adding 2.5 million new subscribers.

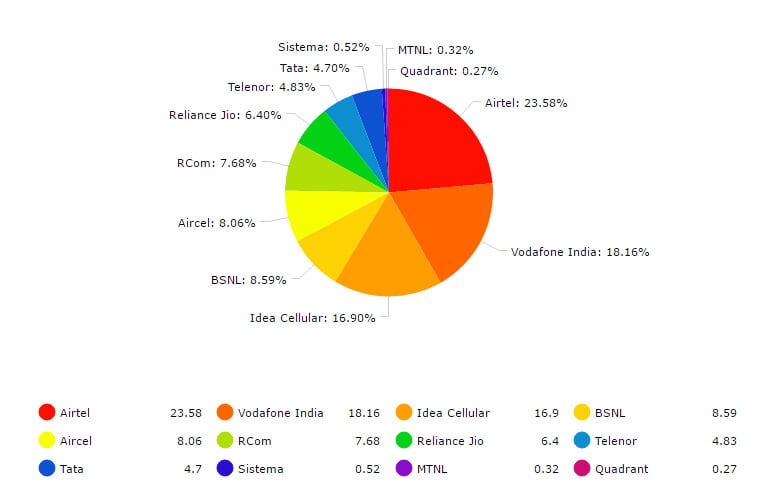

Top telcos market share continue to get lower, still, Airtel tops the Indian telecom sector with 23.58 percent market share. Followed by Vodafone India with 18.16 percent market share and Idea Cellular with 16.9 percent market share. Well, these two telcos are on the verge of a merger that would create India’s biggest telecom operator, overtaking Airtel.

Highlights of Telecom Subscription Data (31st December 2016)

- The number of telephone subscribers in India continues to grow to reach 1,151.78 million, thereby showing a monthly growth rate of 2.48 percent.

- The overall teledensity in India increased to 89.9 at the end of December 2016.

- Total wireless subscriber base which also includes the mobile subscribers increased to 1,127.37 million.

- Private telecom operators hold 91.09 percent of Indian telecom market share. Whereas the government telcos BSNL and MTNL continue losing market share and now stand at 8.91 percent.

- Reliance Jio grabs the maximum number of subscribers to its network, followed by Idea Cellular and Airtel.

On the losing side, Tata Teleservices lost around 1.63 million subscribers during this period. Followed by Sistema (MTS India) and MTNL. - Airtel still holds the top position in India telecom sector with 23.58 percent market share. Followed by Vodafone India with 18.16 percent market share and Idea Cellular with 16.90 percent market share.

- Reliance Jio showed a massive growth rate of 39.1 percent. When compared Airtel has a growth rate of only 0.95 percent.

- Out of the total wireless subscriber base, 988.14 million wireless subscribers were active on the date of peak VLR in the month of December 2016.

- Wireline subscriber base which includes BSNL landline declined to 24.40 million.

- In the month of December 2016 alone a total of 5.67 million requests were received for Mobile number portability (MNP).

- The highest number of MNP requests have been received in Karnataka, followed by Andhra Pradesh and Rajasthan.

Highlights of Broadband Data (31st December 2016)

- The number of broadband subscribers, which include both mobile and wired subscribers increased to 236.09 million at the end of December 2016. Thus registering a monthly growth rate of 8.17 percent. Thanks to the continuing Reliance Jio free voice and data offer.

- Taking mobile broadband subscribers alone, Reliance Jio continues to top the chart with 72.16 million subscribers. Airtel stands second with 41.53 million subscribers and Vodafone India at third with 35.01 million subscribers.

- On wired broadband connection, BSNL tops with 9.95 million subscribers, followed by Airtel with 2.04 million subscribers.