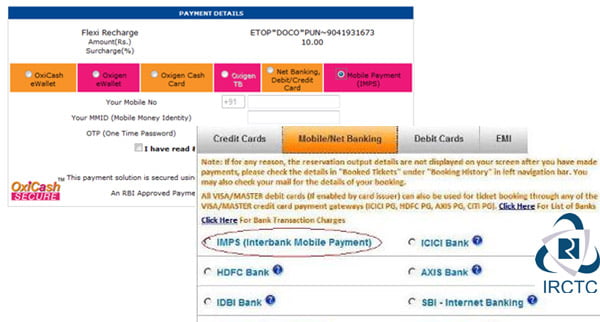

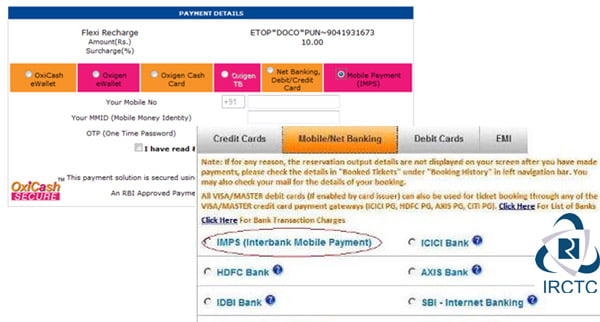

Indian Railway Catering and Tourism Corporation (IRCTC) has brought up another payment facility for consumers, IMPS Merchant Payments (P2M – Person-to-merchant) service which allows customers to make instant, 24×7, interbank payments to merchants or enterprises via their mobile phone.

IMPS is especially designed for mobile banking customers which enables them with a facility to make payment to merchants and enterprises, through various access channels such as Internet, mobile Internet, IVR, SMS, USSD.

Main benefits of IMPS merchant payments service:

- Instant Interbank fund transfer with 24x7x365 availability

- Merchant needs to get on-board IMPS network with one Bank. Customer of any Bank in the IMPS merchant network can make payment to merchant through IMPS

- Anytime, anywhere service

- Highly Safe and secure transaction

- Can use the payment service to pay for Mobile / DTH recharge, Credit card bill payment, Insurance Premium, Landline Bill Payment, Online shopping and Railway Ticket Booking through IRCTC.

Sound interesting, now lets learn how to get started with the IMPS merchant payments service. Customer who wish to avail this service needs to be a mobile banking user of their respective Bank.

- Register mobile number with the account in the respective Bank

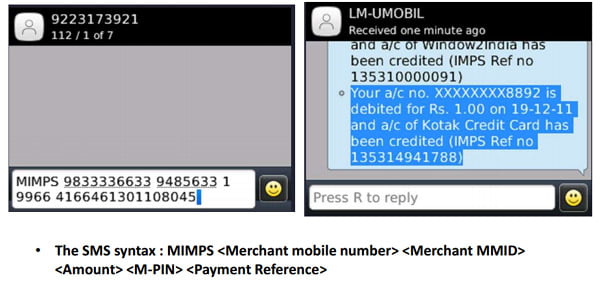

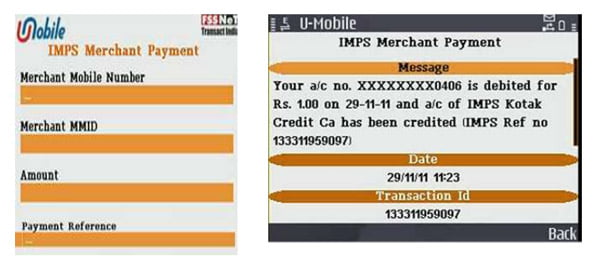

- Get MMID. MMID stands for Mobile Money Identifier and is 7-digit number that is provided by Bank to customer. This number is used to identify customer Bank and is linked to the account number. The combination of mobile number and MMID is unique for the particular account, and customer can link same mobile number with multiple accounts in the same Bank, and get separate MMID for each account

- Get M-PIN. M-PIN is Mobile PIN, a secret password that is provided by Bank to customer. Customer needs to authenticate transaction using M-PIN

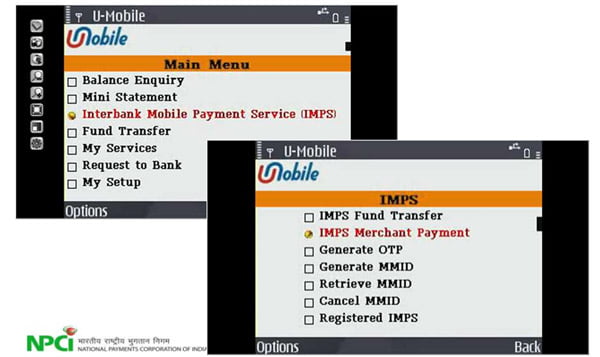

- Download mobile banking application or use SMS / USSD facility provided by the Bank. In order to perform IMPS transactions, customer needs to download mobile banking application or use SMS / USSD facility provided by the Bank

- Perform transaction using mobile banking application or SMS / USSD facility

Currently IMPS is available to customers of the following banks State Bank of India, Union Bank of India, Kotak Mahindra Bank, ICICI Bank, HSBC Bank, Canara Bank and Standard Chartered Bank. There are other banks participating in the test and development phase of IMPS merchant payments, you can check the status here. For registering your mobile number and obtaining MMID for your respective bank check instruction here. You also need to generate OTP from your respective Bank for IMPS transactions (instruction on generating OTP).

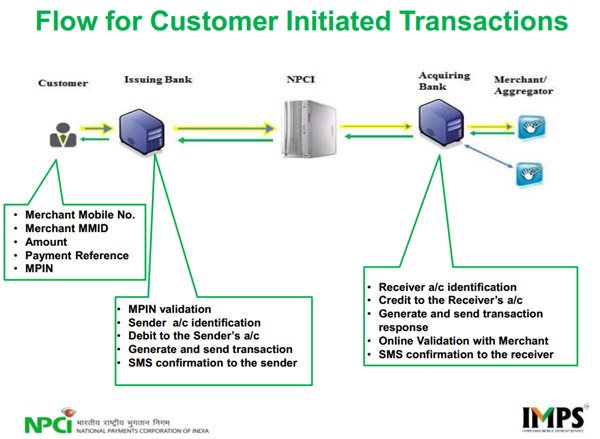

The service is charged at Rs 5 per transaction amount up to Rs 5000 and Rs 10 for above. Want to learn how IMPS works, head over to this presentation (it’s a pdf file and may take some time to load) on IMPS Merchant Payments Process Flow and Use cases. Check the image gallery for some demo of the IMPS service (click on the image for enlarged view).