After HDFC Bank scrapped the idea of charging its customers for United Payment Interface (UPI) transactions two years back, another new-age bank Kotak Mahindra Bank wants to levy a charge for UPI usage from its customers. Starting this May 2019, you will be charged for UPI transactions beyond the monthly limit of 30 UPI transactions.

Unified Payment Interface (UPI) is a payment system by National Payments Corporation of India (NPCI) which backs India government vision towards the cashless digital economy. It’s a more advanced version of IMPS, which lets you transfer money in real-time, 24×7 and via mobile.

In February 2019 alone around UPI clocked 674 million transactions worth over Rs 1 lakh crore. Interestingly more than 80 per cent of these transactions is peer-to-peer (P2P) in nature. That’s between two people, friends or family. Peer-to-merchants (P2M) transaction or one you pay to shops or merchants remain a low use-case. Thus banks are trying to curb this P2P UPI transaction or looking to make some money out this volume.

There have been reports that many banks have approached and discussed with NPCI to levy fees and put a usage cap on the free monthly P2P UPI transactions.

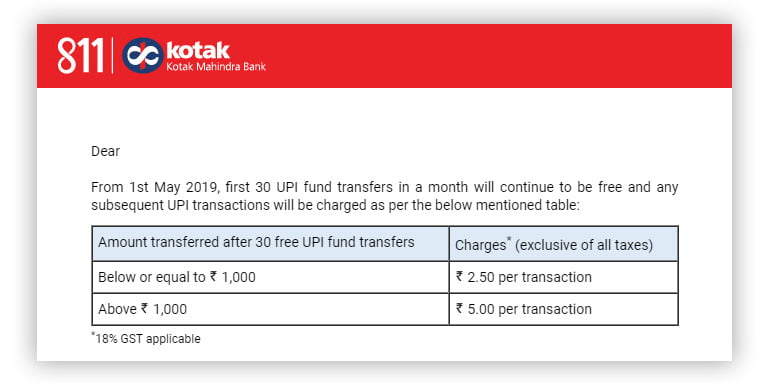

In an e-mail to its customers, Kotak Mahindra Bank has informed its customers that it would charge Rs 2.50 for every UPI transaction worth Rs 1,000 or less. While you would need to shell out Rs 5 for every UPI transactions of more than Rs 1000. Do note that there would be an additional 18 per cent GST charges applicable on this fees.

The above charges are only levied on P2P UPI transactions or when you pay to self or your friends or family. It would be applicable across all platforms like Paytm, PhonePe, Google Pay etc, were you have linked Kotak Bank account. Money transfer to any bank account using account no and IFSC code via above platforms would also be considered within those 30 UPI funds transfers. Thus the same UPI charges will be applicable to these transactions.

For a short relief, the first 30 UPI fund transfers in a month will continue to be free. Also, P2M or merchant payments, online shopping, bill payments etc done via UPI through any platform will continue to be free. This transaction will not be considered under UPI fund transfers.

As one bank has started charging for UPI transactions, other private and public sector banks would follow the route. If bigger banks like State Bank of India (SBI) or HDFC Bank starts levying charging on UPI transfers it would definitely have a negative impact on India’s digital payments ecosystem. Thus forcing people to go back to the old way of cash payments.