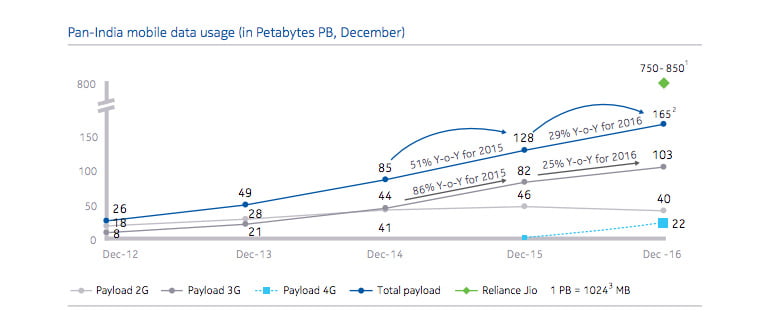

Thanks to Reliance Jio, India now have a data-centric population. Continued 3G and 4G network expansion from Indian telcos and falling data prices have been driving the mobile data traffic growth in the country.

As per Nokia MBiT Index 2017 report, 4G as a technology shows the fastest growth when compared to 2G and 3G roll-out, with a much faster evolving network, device and content eco-system. The data usage on the network of telecom operators almost doubled in six months to 359 petabytes at the end of June 2017. However, this data consumption doesn’t include the Reliance Jio subscribers.

Some key highlights from Nokia MBiT Index 2017

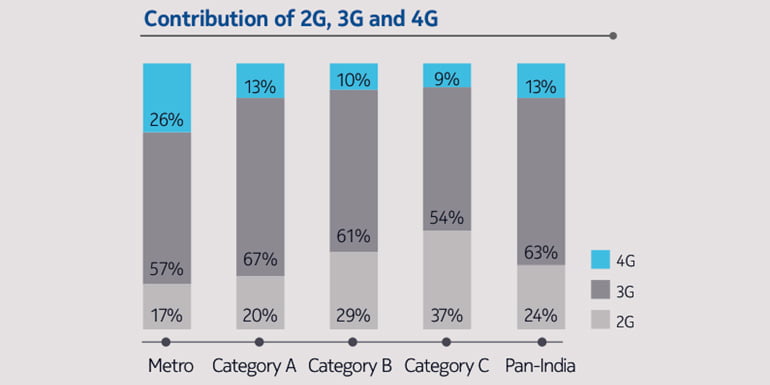

- 3G and 4G combined contributed to 76 percent of the total data traffic.

- The 3G network still remains a significant growth engine, contributing to 63 percent of the total data payload in the country.

- 60 percent of the incremental data payload from 2015 levels was contributed by 4G.

- During the 2015 to 2016 period, 3G grew by 25 percent, while 4G contributed to 13 percent of the total data consumption.

- Even with limited 4G network coverage, data consumption on 4G networks reached 22 PB.

Metro

- This covers Delhi, Kolkata, Mumbai telecom circles.

- Subscribers from Metro circles consumed 31 percent of overall 4G data traffic in the country.

- 3G traffic consumption in 2016 remained flat. It contributed to 57 percent of total metro traffic in 2016.

Category A

- This covers Andhra Pradesh, Gujarat, Karnataka, Maharashtra, Tamil Nadu telecom circles.

- Subscribers from this category consumed 38 percent of the overall 4G data payload.

- 3G traffic grew by 30 percent from 2015 to 2016. It contributed to 67 percent of the total category A traffic in 2016.

Category B

- This covers Haryana, Kerala, Madhya Pradesh, Punjab, Rajasthan, Uttar Pradesh (East), Uttar Pradesh (West), West Bengal telecom circles.

- Subscribers from this category consumed 25 percent of the overall 4G data payload.

- 3G traffic grew by 33 percent from 2015 to 2016. 2G traffic too increased in category B circles by 4 percent.

Category C

- This covers Assam, Bihar, Himachal Pradesh, Jammu & Kashmir, Northeast telecom circle, Orissa telecom circles.

- Subscribers from this category consumed 32 percent of the overall 4G data payload.

- 3G traffic grew by 32 percent and 2G tariff get by 14 percent from 2015 to 2016.

- However, data consumption decreased from 44 percent in 2015 to 37 percent in 2016.

Metro and Category A telecom circles observed a significant decrease in 2G data traffic and rapid shift towards 4G. Whereas 3G continues to grow in Category A circles and remained the primary technology for data consumption in Category B and C circles.

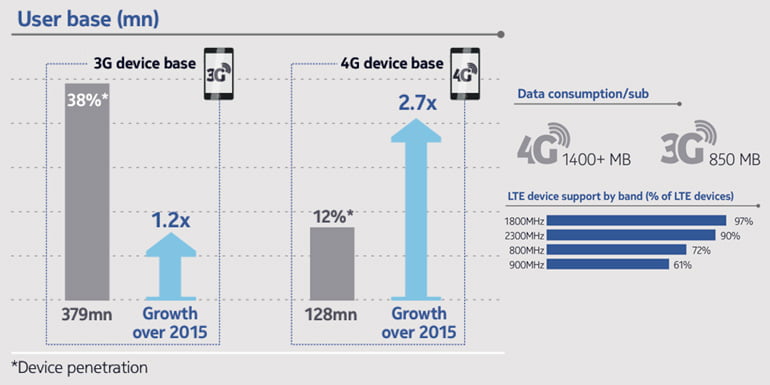

Device Ecosystem

While checking the device ecosystem, 43 percent of all mobile devices shipped in 2016 were smartphones. Under this, 4G-enabled smartphones saw a 2.7x increase over the last year. Thanks to the drop in 4G handsets prices to around Rs 3000 in 2016 and the introduction of zero-priced JioPhone. The average selling price of top 25 selling 4G phones in India remained under the INR 10,000 price range.

LTE device ecosystem continued to develop across bands. Strong device support existed for the 1800MHz and 2300MHz bands, which are the primary bands being used by Indian telecom operators. Note that in India, LTE service been offered on the 800, 1800, 2100 and 2300 MHz bands.

- 7 out of every 10 smartphones shipped in 2016 were 4G-enabled.

- Affordable devices with better specifications, coupled with consumer preference for high-resolution content, are aiding higher data consumption.

- Video remained the largest contributor of mobile data consumption.

- Social media and communication was the driver of user engagement in terms of time spent.