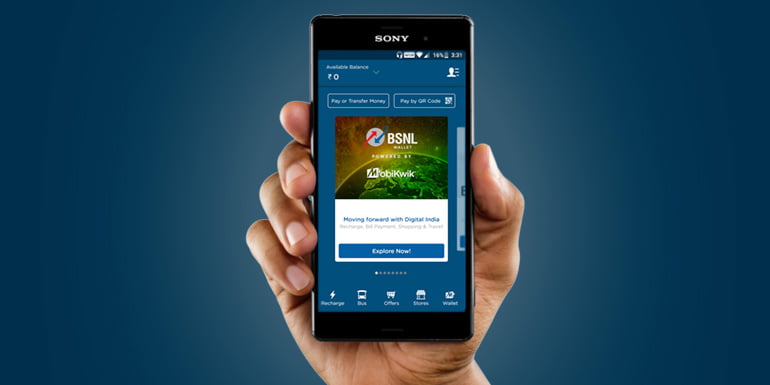

Indian state owned telecommunications company Bharat Sanchar Nigam Limited (BSNL) today launched a semi-closed mobile wallet powered by Mobikwik. The strategic partnership to launch the BSNL Wallet was announced back on 17th May 2017, by both companies. BSNL earlier invited proposals for a mobile-based wallet from interested firms and many did come forward to join them.

BSNL Wallet is a Mobikwik wallet modification with the regular facilities like recharging, point redemption, online and offline usage. However, BSNL will be using the wallet as a digital point for ordering SIMs, and other products. BSNL may also allow users to pay for their services at retail outlets with this new wallet. The wallet is roughly around 5MB in size and is available in play store.

How To Activate BSNL Wallet

- Download the Wallet [link]

- Sign up or Sign in with your mobile number and OTP.

- Edit your profile to add name and email.

- You can also link Payback and Max Get more.

This isn’t the first time they partner with other payment companies to launch an M-Wallet. Two years back, they launched SpeedPay in association with Pyro and during the last year joined with SBI for State Bank Mobi Cash. Users can also pay for BSNL services at their retail outlets with these wallets. As per RBI regulations, BSNL cannot provide its own wallet/payment service. So by partnering with such payment companies, they can have a brand wallet of its own without the licence of a prepaid payment instrument.

Mobikwik was launched in the year 2009 and began the wallet service in 2013 with RBI license. Till now they have partnered with several services to act as payment instrument viz IRCTC, Big Bazaar, MakeMyTrip, and others. They recently came up with the Supercash loyalty program instead of cash backs. By partnering with these wallets BSNL intends to race with private players like Airtel, Idea etc who already have own RBI wallet licenses. Hope you enjoyed the review, Peace!