Do you feel going cashless and digital is a cumbersome task? Like using Credit card or Debit Card number, PIN details every time for making a payment. Adding money and keeping a minimum balance in different digital wallets. Fear of an online fraud happening anytime, like the recent massive ATM hack happened in India. Don’t miss the hidden and hefty bank charges or wallet charges associated with each and every transaction you do.

After the big success of Bharat Interface for Money (BHIM) app, Government of India is making strides to further ease the digital payments process and further pushing towards a complete cashless economy. To ease the payments process for customers and merchants alike, the government has launched Bharat QR. The new standard Quick Response (QR) code, which has been developed co-jointly by the three mobile payment providers in India – Visa, MasterCard, and Rupay (NPCI). One big advantage of using the new payment system is that merchants can accept digital payments from customers without the need for a costly EDC machine or Point of Sale (PoS) swiping machine.

What is Bharat QR?

A new standard QR code that supports Visa, MasterCard and Rupay Credit cards or Debit cards, have a wider acceptance. With Bharat QR code, you just need to scan the Bharat QR code of a merchant or users and then transfer money directly from your bank’s app. It’s as simple as the UPI transaction you do with the BHIM app. That’s not entering or sharing your card details, PIN with anyone. Also, you don’t need to worry whether your card will be accepted at any particular merchant location or PoS machine.

For merchants, they can avoid buying the PoS machine and also do away with the transaction fees charged by the banks on using it. Just like for customers, merchants can also accept any card types like Visa, Mastercard, Rupay or even American Express through Bharat QR. Additionally, all money transfer will be directly reflected on their bank account, instantly and 24/7.

How to use Bharat QR?

With Bharat QR you can use your smartphone to scan Bharat Quick QR code at the merchant outlet and pay from any of your bank accounts instantly. You no longer need to worry whether your card will be accepted at any particular merchant location or need to carry multiple cards. In addition you also not need to enter or share the card details, mobile number or account details with anyone.

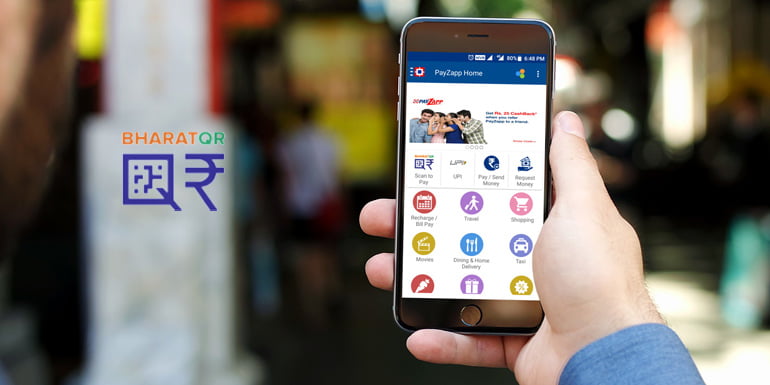

Currently, Bharat QR payment service is supported by fourteen banks app, with rest of the banks soon joining the list. Most of banks UPI apps or core banking apps have been integrated with Bharat QR. At the time of writing ICIC Bank’s Pocket app and HDFC Bank Payapp have been updated with Bharat QR. Also, several banks have released merchant specific Bharat QR apps. Like the YES QR POS and BOI QR Merchant.

- One you have downloaded or updated the bank’s app (like ICICI Pockets or HDFC Payzapp), link you debit card or credit card with the app. You can link any card types like Visa, Mastercard, and Rupay.

- With the bank’s app inbuilt QR Code reader scan the Bharat QR code from merchant outlet.

- You will instantly get a payment screen displaying merchant details and amount to pay.

- Enter the amount to transfer or pay and select from any of your Visa, MasterCard or Rupay cards for payment.

- You then need to authenticate the transaction using passcode or OTP.

- Once authenticated, the money will be transferred from your account to the merchant’s account instantly.

- All transactions are instant and available 24/7.

Bharat QR for Merchants

If you are a merchant, want to go cashless and start accepting digital payment can download their bank specific Bharat QR app. They need to generate the Bharat QR Code from the app, take a print out and stick it in their sale outlet. Customers will scan the QR code and send the money directly to merchants bank account. For each payment, merchants will receive notification fro, their bank and also from the associated app.

Unlike mobile wallets like Paytm and MobiKwik, merchants will no longer have monthly account limits. Also, there won’t be any transaction charges for transferring money to the bank. As with Bharat QR, merchants are receiving money directly on their bank account. Only the usual IMPS charges of your bank are applied on each transaction.

Bharat QR Features

- Scan the Bharat QR code and pay instantly from your card.

- Secure – as you are not sharing your card number, PIN, mobile number or account details with anyone.

- Merchants can accept any card types, as the payment solution has been standardized across all card networks.

- Works with all three mobile payment providers in India – RuPay, Mastercard and Visa.

- No restriction on usage of Credit card or Debit card from any particular provider.

- No additional app required for customers as Bharat QR being integrated with Bank’s own app.

- It can work practically at any location which accepts payments for services.

- Instant money transfer between customer and merchant, 24/7, 365 days.

- Merchants can avoid buying PoS machines and charges associated with it.

The government has earlier launched Unstructured Supplementary Service Data (USSD) based mobile banking that works with every bank and on every phone. This was followed by the launch of Unified Payments Interface (UPI) for smartphones (as well as on feature phone with USSD). It got a mass adoption thanks to the government’s own BHIM app, which is a unified UPI app available for both Android and iOS devices. The government also introduced merchant payment solution with Aadhaar Enabled Payment System (AEPS). It’s an Aadhaar based system which allows you to do basic banking transactions like fund transfer, cash deposit, cash withdrawal and balance enquiry.