The Indian multinational conglomerate Aditya Birla Group has planned to shut down its e-commerce fashion portal abof by the end of 2017. The main factor being the tight competition from lead rivals like Flipkart and Amazon. Also, abof wasn’t good with offers or discounts when compared with other players.

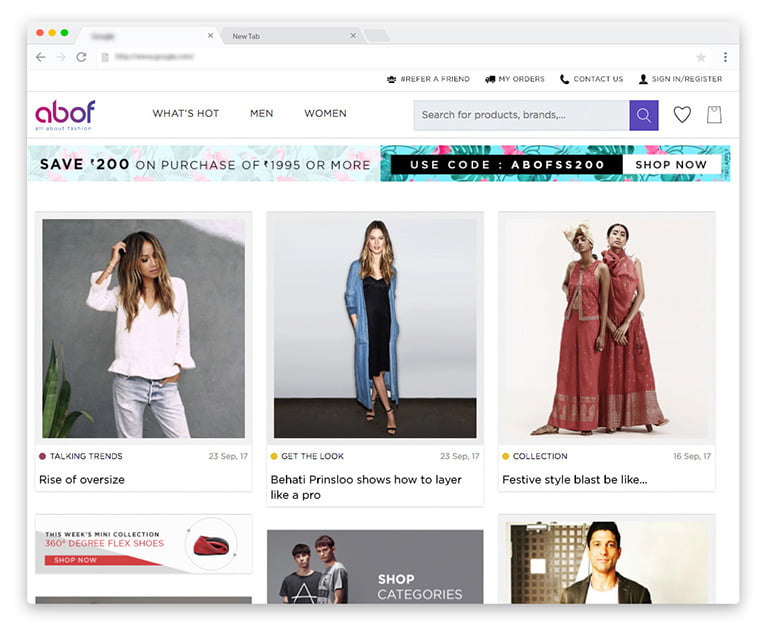

Abof, launched back in October 2015, had its eye in fashion category including clothing, footwear and other accessories. On launch, they specifically stated that no special discounts will be given. This itself was the cause of company’s failure in getting new customers. So, like the many other newly sprouted companies viz Fashionara and Askmebazaar, abof will soon bite the dust.

The marketing strategy followed by top players was too tough for newbies. The two key players, Amazon India and Flipkart, even launched their own fashion and apparel brands like Symbol and Flippd with plenty of offers and promotions. Back in 2014, Flipkart acquired Myntra which was one of the online leading fashion stores. During last year another interesting acquisition of Jabong by Flipkart owned Myntra took place. All these mergers made Flipkart a tough player in the fashion retail market. Even though abof started giving offers and discounts from last year, they couldn’t foresee a good return in near future for the investments.

“We don’t foresee any return on investments in the near future. It is still not mature enough.” Santrupt Mishra, Global HR Head at Aditya Birla Group.

abof presently has 240 employees, and any employee who wants to quit before the shutdown will be provided with four-and-half months’ salary as compensation. They will also close down the stocks from November. Aditya Birla had a similar experience with their first venture, trendin.com, which phased out last year.

abof Shutdown Highlights

- abof to shut down by 31st December 2017.

- Lack of returns on investment

- Tough competition from rivals Flipkart and Amazon.

- Present employees will be offered compensation.

- Stocks to close down starting November 2017.

While others large players are reporting marginal profits, they are also shelling more to gain more customers. SoftBank, the Japanese telecom and media conglomerate, is the major investor in India funding these promotions for Paytm, Flipkart, Snapdeal, Ola, Grofers and others. As per RedSeer Consulting, a researcher tracking, online portals are burning around $ 400 million for sales of $ 1.7 billion. With the festive season kicking in, Amazon, Flipkart, Paytm and other portals are already playing with their trump cards. Hope you enjoyed the article, Peace!