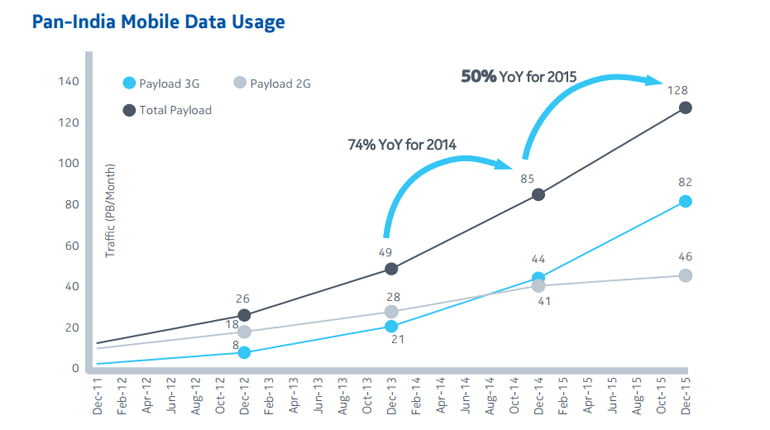

With Indian telecom companies aggressively pushing 3G network across telecom circles and declining prices of 3G enabled devices, the 3G traffic outpaced 2G across all circles for the first time in India – according to Nokia’s MBiT Index 2016 study. The report further reveals that 90% of the mobile traffic is driven by consumption of Video, Social Networking, and Communication related content.

Nokia MBiT Index (Mobile Broadband India Traffic Index) 2016 is a report on mobile broadband performance in India that offers clear-cut insights about mobile broadband traffic growth in the country.

Key Highlights of Nokia MBiT Index 2016:

- 3G traffic grew at around 85% while 2G traffic grew at 12 percent. However, the mobile data traffic is expected to grow further as telecom operators launch 4G LTE networks across India.

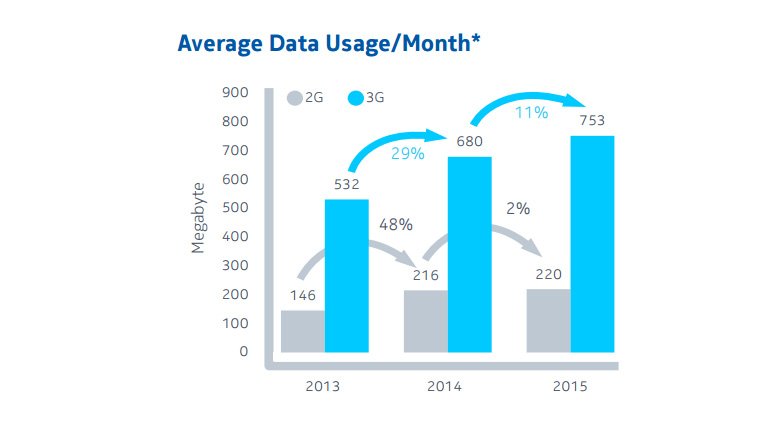

- 3G user base in India grew at 69% YoY while 2G data user base grew at 10% YoY in 2015.

- In Metros and Tier 1 cities 3G traffic grew at 56 percent, contributing to 65 percent of total traffic while 2G traffic declined.

- Category B telecom circles showed the highest growth in 3G traffic, with 79 percent increase in 2015 followed by Category C telecom circles which saw a 3G traffic spike of 64 percent.

- 3G monthly data usage per user in India crossed 750 MB and continues to increase due to better device capabilities and availability of relevant content.

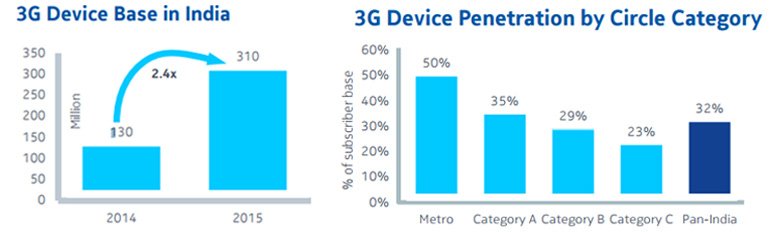

- With a wide range of super affordable 3G android smartphones in the market, 3G device penetration reached all time high of 32 percent in 2015.

- But 3G devices having 3G connections is only 38 percent in 2015, which offer a significant growth opportunity for telecom operators’ to expand their 3G user base.

- One in every two mobile subscribers in Metros has a 3G capable device.

- 19 out of 22 telecom circles now having greater than 20% device penetration. Mumbai has the highest 3G device penetration with 58 percent mobile subscribers having a 3G capable device followed by Delhi, Kerala and Punjab telecom circles.

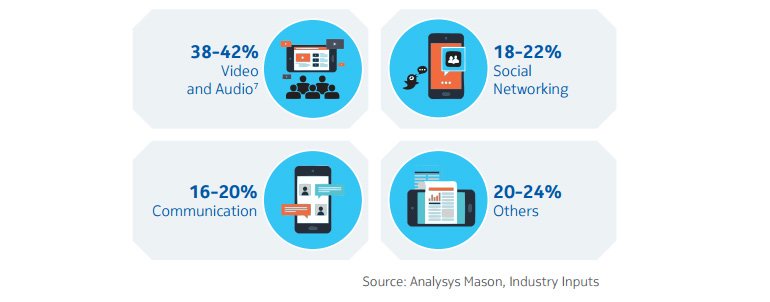

- Video and audio content (YouTube, Saavn, Gaana), and use of social networking (Facebook, Twitter) and communication applications (Whatsapp, Hike) are driving the data traffic both on 2G and 3G networks.

- Around 38-42 percent mobile traffic is consumed by Video and Audio contents, where entertainment content (film, TV and music videos) drives around 90% of video traffic.

- 43% Mobile Internet users access Facebook at least once a month which primarily makes up the 18-22% mobile traffic consumption by Social Networking sites.

- A large share of Facebook users is on 2G network, especially outside metro circles, with 90% Facebook users in India are on mobile.

- Users relay on social networks to consume daily news and information and breaking news.

- Average users spend 20–25 minutes per day on messaging apps that count towards 40% of total time spent on any mobile applications.

- Mobile contributes around 60 percent of the news and information content consumed currently.

- There are 47 million LTE-capable devices in the hand of Indian mobile subscribers that represent 5% of total subscribers in India.

- 8 out of top 15 most used LTE devices (46% of device base) are priced below Rs 10,000.

- LTE capable devices sold in India supports four 4G LTE bands on an average covering 1800 MHz, 2300MHz and 850MHz bands that the primary bands used by the majority of telecom operators to launch LTE in India.